Choosing between CPT modifiers 58 and 78 can cause a massive billing/coding headache.

The problem comes from ambiguity in the definition of modifier 58 and 78. Modifiers 79 and (to a lesser extent) 59 compound the problem. There’s even justified confusion involving modifier 24.

Knowing when to choose modifier 58 over 78 or 79 over 78 is vital. Why?

Using the wrong modifier can mean denied claims. The different modifiers also carry varying reimbursement schemes. For instance, Modifiers 59 and 78 can reduce Medicare reimbursement below 100%.

Tip: This simple, quick, easy-to-grasp guide demystifies the confusion between these closely related modifiers. Print the modifier PDFs below for handy reference, or simply bookmark this page.

How to Choose: Modifier 58, 59, 78, 79

To say the least, knowing how to decide between modifier 58 and 78 can be a tricky game. Modifiers 59 and 79 can also come into play.

Worse, most of the information currently available on the internet doesn’t exactly clarify the problem. The lion’s share of articles online quote Medicare rules, then make the reader wade through a sea of words to try to wrangle out the meaning.

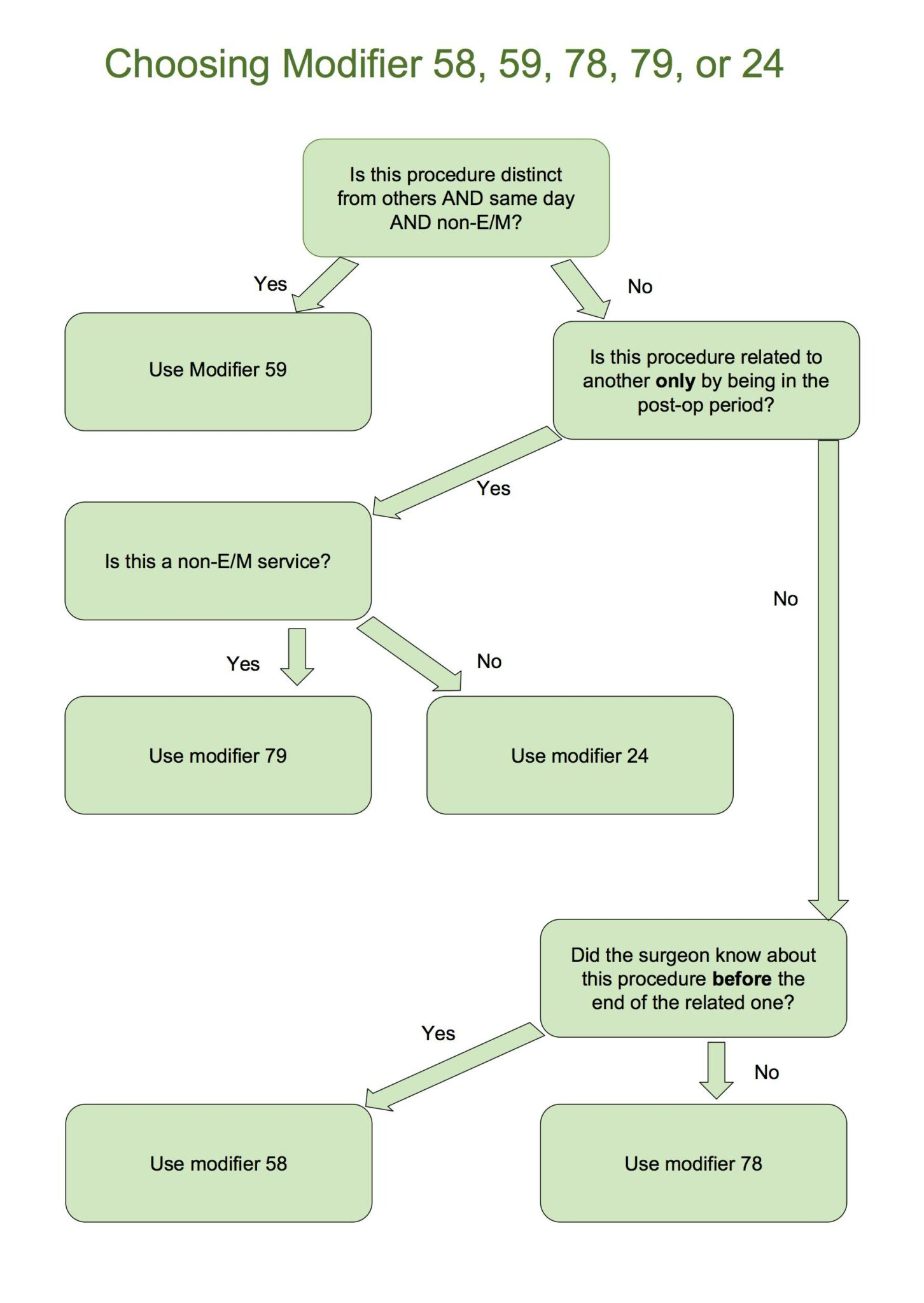

The decision tree below aims to simplify the choice between modifiers 58, 78, 79, and 59. Is it an official Medicare/CPT definition? No. It’s built from an analysis of CPT rules, so use it with a grain of salt.

Note also that the chart below doesn’t cover modifier 24.

We’ll get into in-depth explanations in a minute. For now, and without further preamble, here’s the decision tree. Click it to access the modifier 58 PDF, so you can download it and print it out for future reference.

The “More Extensive” Caveat for Modifier 58

One caveat to the chart above:

Modifier 58 also refers to procedures that are “more extensive than the original procedure.” We’ll dig into that in a minute. For now, think of it like this: A biopsy results in an operation to excise a tumor two weeks later. The excision procedure is “more extensive.” Yet it also was “prospectively planned.” That is, the more important condition is that the surgeon knew about its possibility when she performed the biopsy.

Using the Modifier Decision Tree Above

The chart above should clarify how to choose modifier 58, when to choose modifier 78, and when to decide on other related modifiers like 79, 59, and 24.

The chart isn’t an official CMS document. Rather, it was built from an analysis of CPT modifier definitions and explanations on the CMS.gov website. It’s a good rule of thumb, in other words, but it’s best to read the full definitions, conditions, and examples below.

Find Out How Much You Can Save Instantly.

Try our on-line savings calculator.

What Are the Modifiers?

Modifiers 58, 78, 59, 79, and 24 are billing code modifiers applied to surgery claims. They each have very specific, though related definitions. They often cause confusion, especially between modifiers 58 and 78, but also among 59, 79, and even 24. Here are the definitions, according to Current Procedural Terminology (CPT):

WARNING: The definitions below are from CMS.gov, and are confusing. They’re provided here more to show the confusion than to clear it up. For clarity, see the decision tree above or the “How to Choose” section below.

- Modifier 58 Definition: “Staged or related procedure or service by the same physician during the post-operative period.”

- Modifier 78 Definition: “Unplanned return to the operating or procedure room by the same physician following initial procedure for a related procedure during the post-operative period.”

- Modifier 79 Definition: “Unrelated procedure or service by the same physician during a post-operative period.”

- Modifier 59 Definition: “Distinct Procedural Service: Under certain circumstances, it may be necessary to indicate that a procedure or service was distinct or independent from other non-E/M services performed on the same day…”

- Modifier 24 Definition: “Unrelated E/M service by the same physician during a post-operative period”

From the definitions above, the source of the confusion is clear. Modifier 58 and 78 could both refer to the same procedure, couldn’t they? They’re both during the post-op period. 58 could be “staged/planned,” while 78 could be “unplanned,” right? Except that 58 also says “or related.” That seems to indicate that a related, unplanned procedure could use either modifier 58 or modifier 78.

Modifiers 79, 59, and 24 contain their own points of confusion. As we’ll show in a bit, modifiers 58 and 78 are actually very different. It’s only the wording of the CMS definition that trips up some health care pros.

How to Choose the Modifiers

The decision tree above should clarify how to decide between modifier 58 and 78. Since those are the two most often conflated CPT billing codes, we’ll tackle them first.

We’ve provided the in-depth explanations and examples below so readers can check our math. Use the decision tree above in other words, but don’t neglect your own due diligence.

We’ll also address modifiers 24, 79, and 59.

When to Use Modifier 58

Modifier 58 is used for a “staged or related procedure or service by the same physician during the post-operative period.”

Further, according to CMS.gov, modifier 58 indicates that the procedure was:

- Planned, either at the time of the first procedure or prospectively.

- More extensive than the first procedure.

- For therapy after a diagnostic surgical procedure.

There’s some ambiguity here, because nowhere in the CPT manual does CMS clarify whether the above conditions are separated by “or,” or “and.” However, it’s generally assumed that the conditions are “or” cases. That is, any one of them can by itself trigger the use of modifier 58.

For billing purposes, CMS states that the next procedure in the series starts a new post-operative period.

Clarifying Modifier 58

Modifier 58 covers a return to the OR. It’s always for a related procedures. It’s always during the post-op period.

The key with modifier 58 is that it almost always covers a procedure the doctor knew about before the end of the related, first operation.

For example, a surgeon does a biopsy, finds cancer, and has to bring the patient back to remove the rest.

Examples of When to Use Modifier 58

The following examples illustrate different situations when modifier 58 should be used.

Modifier 58 Example #1

A surgeon performs a biopsy on a patient. The results indicate that the sample is cancerous. The surgeon performs a second procedure to remove the cancer. Use modifier 58 when billing for the second procedure. Why? Because the surgeon knew the biopsy might result in a further, more extensive procedure, pending test results.

Modifier 58 Example #2

A surgeon performs a procedure to debride a sacral ulcer. During the procedure, the surgeon knows she must perform a skin graft on the ulcer site at a later date. The skin graft will be billed with modifier 58. Why? Because during the original procedure, the physician knew the graft procedure would take place.

When NOT to Use Modifier 58

- If a different physician performs the second procedure.

- If the procedure is unrelated.

- If the procedure doesn’t take place in the post-operative period.

- If the procedure was not staged/planned at the time of the first procedure.

- In cases of assistant-at-surgery services.

When to Use Modifier 78

Use modifier 78 for “Unplanned return to the operating or procedure room by the same physician following initial procedure for a related procedure during the post-operative period.”

The gist of that is, choose modifier 78 for a related operation that wasn’t planned in advance.

For example, a surgeon does a biopsy. The site gets infected, and the patient has to come back for a second operation to remove the infection.

The caveats here are:

- The subsequent procedure must take place in the operating room.

- The second procedure must be related to the first.

- The use of modifier 78 isn’t limited only to complications.

Clarifying Modifier 78

Like modifier 58, modifier 78 also concerns a patient’s return to the OR. It’s always for a related procedure. It’s always also during the post-op period.

Unlike modifier 58, modifier 78 covers operations the doctor didn’t plan, even by the end of the first procedure.

In other words, with modifier 78, the need for the procedure wasn’t known until after the first procedure ended.

Examples of When to Use Modifier 78

The examples below show when to use modifier 78 instead of modifier 58.

Modifier 78 Example #1

A physician performs a caesarian section on a patient. Because of bleeding, the patient is called back into the OR for a second procedure. The second procedure was unplanned, in the post-operative period, and performed by the same surgeon. Therefore modifier 78 is applied to the claim.

Modifier 78 Example #2

A physician removes cataracts from both of a patient’s eyes. Vision in the right eye quickly returns to normal. However, vision in the left eye requires a YAG laser capsulotomy. Modifier 78 is used. Why? The second procedure was performed in the post-operative period, by the same physician. However, the doctor didn’t plan or know of the need for the second procedure until after the first.

Examples of When NOT to Use Modifier 78

- When the procedure is planned or staged during a previous procedure.

- When the procedure is unrelated to the previous one.

- When the procedure doesn’t occur in the post-operative period.

- When a different physician performs the procedure.

- When the procedure isn’t performed in the operating room. (An OR can include an endoscopy suite, cardiac catheterization suite, or a laser suite.)

When to Use Modifier 79

Modifier 79 is for an “unrelated procedure or service by the same physician during a post-operative period.”

Modifier 79 is like modifiers 58 and 78. It covers procedures by the same doctor in the post-op period.

However, there’s a big, clear difference with modifier 79.

Use modifier 79 for unrelated procedures.

Modifiers 58 and 78 are always for procedures related to another procedure.

With modifier 79, it doesn’t matter whether the procedure was planned or unplanned during the previous procedure, because there’s no connection between the different operations.

Examples of When to Use Modifier 79

The examples below illustrate the proper use of modifier 79.

Modifier 79 Example #1

A patient’s right big toe is amputated because of an infection. Within the post-operative period, the same physician amputates the patient’s right little toe after it is crushed by a falling weight. Modifier 79 is used. Why? Because the two operations are completely unrelated, though they may seem similar.

Modifier 79 Example #2

A physician performs exploratory surgery on a lump discovered in a patient’s forearm. The lump turns out to be a benign cyst. Within the post-op period, the same patient returns to have a fibroma removed by the same physician. The two incidents are unrelated, so modifier 79 is used.

Examples of When NOT to Use Modifier 79

- When the two surgeries are related.

- When a different physician performs the operation.

- When the operation happens outside the post-op period.

- When the procedure is performed somewhere other than the operating room.

When to Use Modifier 24

Like modifier 59, modifier 24 is easily distinguished from 58 and 78.

It refers to “Unrelated E/M service by the same physician during a post-operative period.”

It’s similar to modifier 78 because both refer to “unrelated” service by the same physician in the post-op period.

However, modifier 24 is different from modifier 78 because 24 refers only to E/M service.

78 does not refer to E/M service, but to non-E/M procedures or services.

Additional Details About Modifier 24

Modifier 24 covers any E/M service in the post-op period that’s not related to the original procedure.

Any E/M service billed under modifier 24 has to have documentation to support that the service isn’t part of the post-op care for the original procedure.

Examples of When to Use Modifier 24

See the examples of modifier 24 in use below.

Modifier 24 Example #1

A surgeon performs a procedure to repair a hernia. Within the post-operative period, the patient comes back to the same doctor to have a lump on his arm evaluated. The second procedure uses modifier 24. Why? Because the two procedures are unrelated and because the second procedure is an E/M procedure.

Modifier 24 Example #2

A physician performs ACL surgery on a patient. Within the post-operative period, the same surgeon evaluates the patient for wrist pain. The second visit is billed under modifier 24.

Examples of When NOT to Use Modifier 24

- When it’s not an E/M service.

- When it’s not during the post-operative period.

- When the service is conducted by a different physician.

- When the service is related to the previous procedure.

When to Use Modifier 59

Modifier 59 is used for a procedure/service that’s “distinct or independent from other non-E/M services performed on the same day…”

The CPT definition of modifier 59 is actually a lot longer than that, but we can stop right there. Why? Because we’ve already got all the info we need. We can already distinguish it clearly from modifier 58 and modifier 78, as well as 79.

Consider: Modifiers 58, 78, and 79 all refer to “unrelated procedures/services or E/M services in the post-op period.”

Modifier 59 refers to “non-EM” service performed “on the same day.”

Same Day vs Post-Operative

One point of confusion between modifier 59 and modifier 79 is that both can refer to unrelated, non-E/M services or procedures performed during the post-operative period. Why?

Because A) modifier 59 refers to same-day service and B) the post-operative period can technically start on the “same day.”

While that’s true, “same day” is more specific, so modifier 59 should be used instead of 79 for same day, non-E/M service.

Clarifying Modifier 59

The explanation above should show modifier 59 as distinct from modifiers 58, 78, and 79. For further clarification, only use modifier 59 when the procedure/service happened on the same day as another, and only when it’s a non-E/M procedure/service.

To confuse things a bit more, modifier 59 could possibly refer to the same session, as long as it involves a different site, injury, or organ system that wouldn’t normally be included in the first operation. (For example, a doctor removes a cyst from a patient’s abdomen, and in the same session amputates part of the patient’s infected toe.)

However, according to CMS, “when another already established modifier is appropriate,” that other modifier should be used in place of modifier 59.

There’s no reason to confuse modifier 59 with modifier 58, 78, or 79.

That said, modifier 59 is confusing for its own reasons.

Examples of When to Use Modifier 59

Let’s look at three examples of when to use modifier 59.

Modifier 59 Example #1

A physician uses laser surgery to destroy an actinic keratosis on a patient. It’s the first lesion discovered on the patient. In the same session, a skin biopsy is performed at a different site on the same side of the body.

Modifier 59 is used on the skin biopsy. Why? Because the two procedures were performed at different sites, and because the sites were on the same side of the body. (If they’re on different sides of the body, use either modifiers RT and LT or some other modifier. Yes, modifier 59 has its own problems, but this example should at least distinguish it from modifier 58, 78, and 79.)

Modifier 59 Example #2

A physician cuts away a benign hyperkeratotic lesion on a big toe. In the same session, the physician debrides a toenail on a different toe. Modifier 59 is used. Why? These are different sites, and the procedures are not ordinarily performed together.

Doesn’t this sound like a case for modifier 79? It does, but A) this is a same-session procedure, not “during the post-operative period.” B) The second procedure is a non-E/M procedure.

Modifier 59, Example #3

A patient has a cardiovascular stress test. Later that same day, the patient also has an ECG. This is a job for modifier 59. Why? These two tests are clearly related. Shouldn’t they be billed with modifier 58? No, because although the “same day” could technically be called part of “the post-operative period,” the definition of modifier 59 clearly focuses on “the same day.” That’s much more specific than “post-operative.” Further, this is a non-E/M service.

It’s tricky, but modifier 59 refers to non-E/M procedures on the same day either “on different sites or organs” or “in different sessions.”

Examples of When NOT to Use Modifier 59

- If the two procedures are performed on the same site, organ, or system.

- If the two procedures are not “separate and distinct.”

- If another modifier describes the procedure better (modifier 58, modifier 78, or other).

- If the procedure is an E/M service.

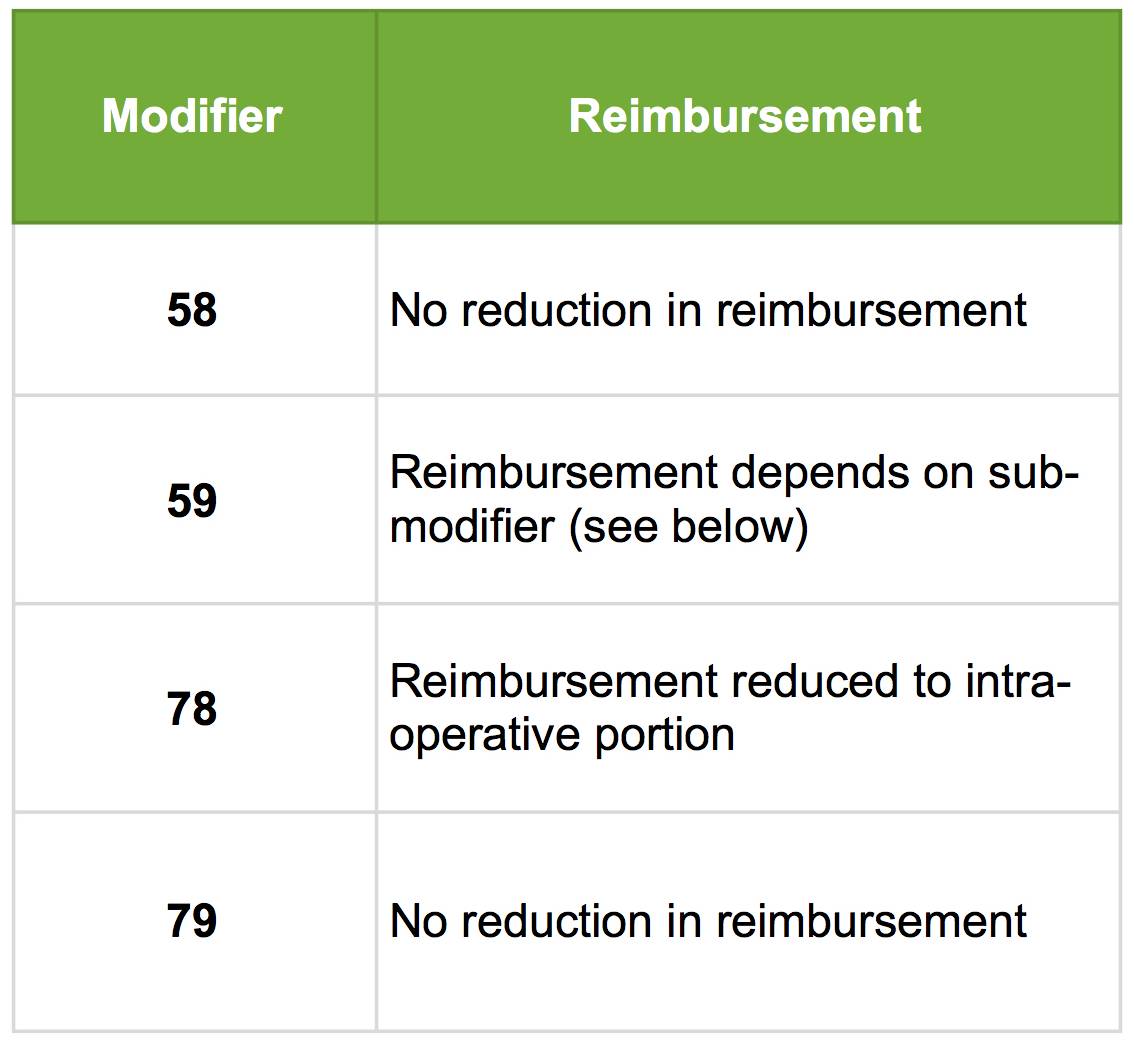

How Modifier 58, 78, 59, 79, and 24 Affect Reimbursement

Different CPT modifiers affect reimbursement in different ways.

Modifier 58 and modifier 79 don’t affect reimbursement. That’s because they both cover related procedures in the post-op period.

Modifier 59 and modifier 78 both affect reimbursement to some extent.

Modifier 78 reduces reimbursement to the intra-operative portion, according to the payor’s fee schedule. That usually means reimbursement at about 70% to 80%.

Modifier 59’s reimbursement reduction depends heavily on sub-modifiers. (See below.)

To further complicate things, in 2015, modifier 59 was appended with the more specific modifiers XE, XS, XP, and XU.

These cover:

- XE: Separate encounter

- XS: Separate practitioner

- XP: Separate structure/organ

- XU: Unusual non-overlapping service (doesn’t normally connect with the main service.)

Each modifier affects reimbursement in different ways.

Conclusion

Modifiers 58, 78, 59, 79, and 24 all seem to overlap in confusing ways.

Modifier 58 and modifier 78 are often mixed up, because both refer to related procedures by the same physician in the post-operative period. However, modifier 58 generally describes staged/planned procedures, while modifier 78 is used for unexpected procedures.

Modifiers 59 and 79 can be confused as well. Both can refer to unrelated procedures by the same physician. However, 79 focuses on the post-operative period, while 59 centers more specifically around same-day or same-session procedures.

Finally, modifier 24 covers only E/M services by the same physician during the post-op period.

Billing with the right modifiers means less denied claims and higher reimbursement. That means health care workers can ultimately save money for employers.

Another great feather in the cap is finding a lower cost medical waste vendor. See how much your facility could save with MedPro Waste Disposal by trying out the savings calculator below.

Find Out How Much You Can Save Instantly.

Try our on-line savings calculator.

Reference